No mon

no fun

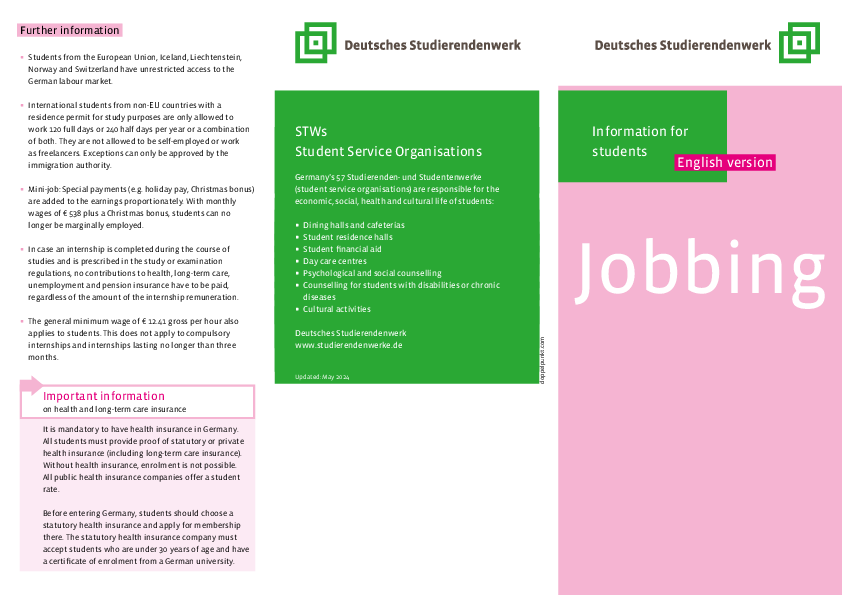

There are a few things to consider when it comes to part-time jobs during your studies.

Here you can find our tabular overview of job opportunities to get you started:

You can also find more information on the website our association, Deutsches Studierendenwerk (DSW).

By phone, video and on site

Free of charge and confidential: We are there for you. Gladly also in English.

Unfortunately, no contact persons could be found.